What is the focus of Stark Law?

The Stark Law, named after U.S. Congressman Pete Stark who originally sponsored it, is a provision of U.S. federal law that prohibits physicians from referring Medicare patients for certain designated health services (DHS) to entities with which the physician or an immediate family member has a financial relationship, unless an exception applies. The primary purpose of the Stark Law is to combat Medicare and Medicaid fraud and abuse by eliminating the influence of financial incentives in physicians’ medical decision-making.

Key points about Stark Law include:

- Financial Relationships: These can be either ownership/investment interests or compensation arrangements.

- Designated Health Services (DHS): Services covered by the Stark Law include clinical laboratory services, physical therapy, radiology services, durable medical equipment, outpatient prescription drugs, and several other categories.

- Exceptions: The Stark Law has numerous exceptions that allow for certain arrangements that are deemed to not pose significant risks to the program or patient abuse. Examples of these exceptions include certain rental agreements, personal services arrangements, and payments that are consistent with fair market value.

- Penalties: If a physician or entity violates the Stark Law, they can face significant fines for each service they bill. Moreover, they can also be denied payment for these services and can be excluded from participating in federal healthcare programs.

- Intent: One distinguishing feature of Stark Law compared to other fraud and abuse laws, like the Anti-Kickback Statute, is that it is a strict liability statute. This means that intent or knowledge of the law isn’t necessary for a violation to occur. If a prohibited referral is made and no exception applies, then the Stark Law is violated regardless of whether the physician intended to break the law.

- Self-referral: Stark Law is often referred to as the “self-referral” law because of its focus on financial relationships that could lead a physician to “self-refer” patients to entities they have an interest in.

Is Stark Law a criminal statute?

No, the Stark Law is not a criminal statute. It is a civil statute. Violations of the Stark Law can result in civil monetary penalties, including fines and potential exclusion from participation in federal healthcare programs like Medicare and Medicaid. However, it does not carry criminal penalties.

That said, certain conduct that violates the Stark Law might also violate other statutes that do carry criminal penalties, such as the Anti-Kickback Statute. The Anti-Kickback Statute is a separate federal law that criminalizes the exchange of remuneration for referrals involving any item or service reimbursable by federal healthcare programs.

But, in and of itself, Stark Law violations are addressed through civil enforcement mechanisms.

Stark Law Violations Examples

Stark Law is complex and can be violated in various ways, depending on the specific circumstances of the financial relationship and the referrals made. Here are some examples of potential Stark Law violations:

- Ownership in Imaging Centers: Suppose a physician owns an interest in an imaging center and refers their Medicare patients to that center for MRI scans without meeting any of the Stark Law’s exceptions. This could be a violation.

- Office Space and Equipment Rentals: A physician rents office space or equipment from a hospital at below fair market value and, in return, refers Medicare patients to that hospital. This can be a violation if the rental rates aren’t consistent with fair market value and don’t meet other specific requirements of the rental exception.

- Improper Compensation Arrangements: A hospital pays a physician more than fair market value for services rendered, or the compensation is determined in a way that considers the volume or value of the physician’s referrals to the hospital.

- Unwarranted Bonuses: A physician group divides up its bonus pool based on the volume or value of referrals made by its members to an affiliated physical therapy clinic in which the group has an ownership interest.

- Non-compliant Joint Ventures: A physician and a surgical center enter into a joint venture where the physician refers patients to the surgical center. If the joint venture doesn’t fit into one of Stark’s exceptions, it could be a violation.

- Personal Services Arrangements: A hospital contracts with a physician for consulting services. However, the physician doesn’t provide these services, and the contract is merely a guise to reward the physician for patient referrals.

- Cross-Referral Agreements: Two physicians agree that one will refer all his physical therapy patients to the other in exchange for the second physician referring all his radiology patients to the first. Such a “you scratch my back, I’ll scratch yours” arrangement can be a Stark Law violation.

- Compensation Based on Productivity: A hospital compensates a physician based on the physician’s productivity, including tests and procedures performed in the hospital. If this compensation indirectly relates to the physician’s referrals to the hospital, it could be problematic under Stark Law.

Stark Law Exceptions

The Stark Law contains numerous exceptions that allow certain financial relationships or arrangements to exist without violating the law. Here are some of the commonly referenced exceptions:

- Physician Services Exception: This exception applies when a physician provides services personally or through employees, partners, or shareholders of their group practice.

- Rental of Office Space or Equipment Exception: If the rental arrangement is in writing, specifies the covered premises or equipment, has a term of at least one year, and the rent is set at fair market value (and not determined in a way that takes into account the volume or value of referrals), then it might fall under this exception.

- Bona Fide Employment Relationships: Compensation paid by an employer to a physician employee is generally permissible if the amount does not vary based on the volume or value of referrals and is at fair market value for the services provided.

- Personal Services Arrangements: Payments to a physician for personal services are allowed if the arrangement is in writing, specifies the services covered, and the compensation is at fair market value without considering the volume or value of referrals.

- Physician Recruitment Exception: Hospitals can provide incentives to recruit physicians to practice in their community under certain conditions.

- Isolated Transactions: This includes things like a one-time sale of property or practice, provided that the compensation is at fair market value.

- Fair Market Value Compensation: Payments made by a healthcare entity to a physician for assets or services can be permissible if the compensation is consistent with fair market value, and the arrangement does not take into account the volume or value of referrals.

- Group Practice Arrangements with a Hospital: A hospital can compensate a group practice in a way that does not directly relate to the volume or value of referrals by any specific physician.

- Non-Monetary Compensation: Non-monetary compensation up to a certain annual limit (which can be adjusted annually for inflation) is permitted, as long as the compensation doesn’t explicitly relate to the volume or value of referrals.

- Charitable Donations by a Physician: A physician can donate to a healthcare entity as long as the entity doesn’t condition its business with the physician based on the donation.

- Indirect Compensation Arrangements: An indirect financial relationship might be allowed if certain criteria are met, including that the compensation is at fair market value and does not vary based on the volume or value of referrals.

- Preventive Screening Tests, Immunizations, and Vaccines: Provision of these services for free or at a reduced rate is allowed under certain circumstances.

- Electronic Health Records (EHR) Items and Services: Donations of EHR software or services are allowed under specific conditions.

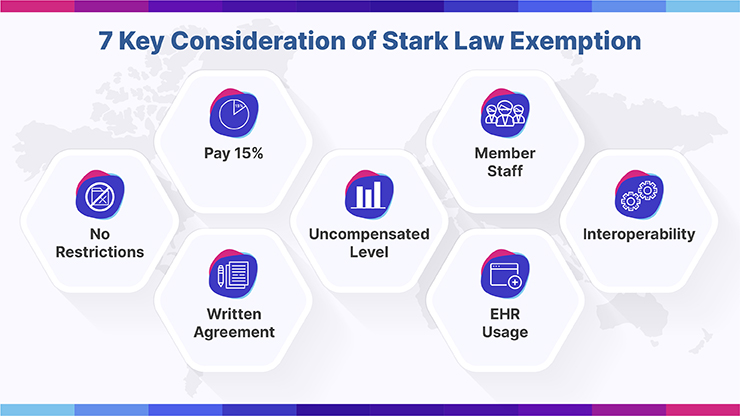

What Are Conditions to Stark Law Exceptions?

The Stark Law provides numerous exceptions, and each exception has specific conditions that must be met to ensure that the financial relationship or arrangement in question does not violate the law. Below are some of the conditions for a selection of commonly referenced Stark Law exceptions:

Physician Services Exception:

- Services must be provided either personally by the referring physician, or by an individual who is an employee, independent contractor, or member of the referring physician’s group practice.

- The compensation for the services must be consistent with fair market value and not determined in a way that considers the volume or value of the referrals.

Rental of Office Space or Equipment Exception:

- The lease must be in writing and signed by both parties.

- The lease must specify the premises or equipment being leased.

- The rental term must be at least one year.

- The rental charge must be set in advance, consistent with fair market value, and not determined in any manner that considers the volume or value of referrals.

Bona Fide Employment Relationships:

- The employment is for identifiable services.

- The compensation is at a fair market value.

- The compensation is not based on the volume or value of referrals by the referring physician.

Personal Services Arrangements:

- The arrangement is in writing, signed by both parties and specifies the services to be provided.

- The arrangement covers all of the services to be provided by the physician.

- The compensation is set in advance, does not exceed fair market value, and is not based on the volume or value of referrals.

Physician Recruitment Exception:

- The recruitment incentive is provided by a hospital to a physician to induce the physician to relocate to the hospital’s geographic area and join the hospital’s medical staff.

- The compensation does not take into account the volume or value of anticipated or actual referrals.

Isolated Transactions:

- The transaction, such as a one-time sale, is truly one-time and not a series of transactions.

- The compensation is consistent with fair market value.

Non-Monetary Compensation:

- The compensation does not exceed a certain annual limit (adjusted for inflation).

- The compensation is not solicited by the physician or the physician’s practice.

- The compensation is not determined in any manner that considers the volume or value of referrals.

Electronic Health Records (EHR) Items and Services:

- The software must be interoperable.

- The donor (or any person on the donor’s behalf) doesn’t take any action to limit the usability or interoperability of the EHR items or services.

- The physician pays 15% of the donor’s cost for the EHR items and services.

What Are Penalties for Stark Law Violations?

Stark Law violations can result in severe consequences. Here are the primary penalties for violations of the Stark Law:

- Denial of Payment: Medicare can refuse to pay for any service that is furnished as a result of a prohibited referral.

- Refund of Payments: If payment has already been made by Medicare for services that were furnished as a result of a prohibited referral, the entity that billed for the services may be required to refund the amounts received.

- Civil Monetary Penalties (CMP):

- For each service a person bills that result from a prohibited referral, a civil monetary penalty of up to $15,000 (as of the last update before 2022; amounts may be adjusted for inflation) can be imposed.

- If one enters into a circumvention scheme (an arrangement or scheme that has the principal purpose of ensuring referrals by the physician to a particular entity), one can face a civil monetary penalty of up to $100,000 per such scheme.4. Exclusion from Federal Healthcare Programs: Entities or physicians who violate the Stark Law may also be excluded from participation in Medicare, Medicaid, and other federal healthcare programs

5. False Claims Act Liability: Billing for services that resulted from prohibited referrals can also constitute a false or fraudulent claim under the False Claims Act. If found liable under the False Claims Act, entities or individuals can face treble damages (i.e., three times the damage sustained by the government) and additional penalties for each false claim. Given the severity of these penalties, healthcare providers and entities need to be vigilant about their compliance with the Stark Law. It’s advisable to consult with legal counsel familiar with healthcare regulations when considering financial relationships or arrangements that might implicate the Stark Law.

Benefits of the new Stark Law Exceptions

The changes to the Stark law regulations, along with the changes to the AKS and the Beneficiary Inducement CMP aim at providing regulatory relief to physicians who had to juggle between two different systems.

Most health plans, including Medicaid, have shifted to value-based care. They pay physicians for the quality of care, while the physicians are still working under a fee-for-service system. How did this happen?

This is because the previous regulations were tailored for a system in which physicians were paid for their services. The law kept a check on fraud by penalizing unnecessary referrals. A physician can get penalized for certain referrals, even if the referral violates the law unknowingly or accidentally.

On the other hand, value-based requires physicians to work with other care providers. Under the new system, physicians are paid not for their service but for the quality of care that the patient receives.

To cover such issues, the final rule has added several exceptions. The first applies to value-based systems in which the enterprise assumes the full financial risk from the payor.

The second applies to arrangements under which the physician is at downside monetary risk for failing to achieve the value-based purpose of the enterprise. And the third applies to any value-based arrangement if it meets certain conditions. For this exception, CMS has defined some requirements. These conditions would guard patients against fraud under the exception.

In addition, the new exceptions have done away with the typical Stark law requirements. This includes conditions, such as the compensation should be consistent with the fair market value, or that, it should be set in advance. But, they do require that the system should be reasonable.